Understanding Superbills and Out-of-Network Insurance Benefits

- What is Out-of-Network Insurance? Understanding the Basics

- What Insurance Plans Offer Out-of-Network Benefits and How Do I Check My Coverage?

- The Importance of Understanding Your Coverage

- What are Superbills and How Are They Used?

- How are Superbills Submitted?

- Insurance Reimbursement & Superbills at Thriving Center of Psychology

Navigating the healthcare system can sometimes feel like deciphering a complex puzzle, especially when it comes to understanding out-of-network insurance and superbills. This article aims to demystify these concepts, what out-of-network insurance entails, including eligible plans and how to check for out-of-network coverage as well as providing a clear understanding of what superbills are, how they are used and submitted.

What is Out-of-Network Insurance? Understanding the Basics

Out-of-network insurance refers to coverage provided for services received from providers who do not have a contract with your insurance company. These services typically cost more than those received from in-network providers, but depending on your insurance plan, a significant portion of these costs can be reimbursed once you’ve met your out of network deductible.

What Insurance Plans Offer Out-of-Network Benefits and How Do I Check My Coverage?

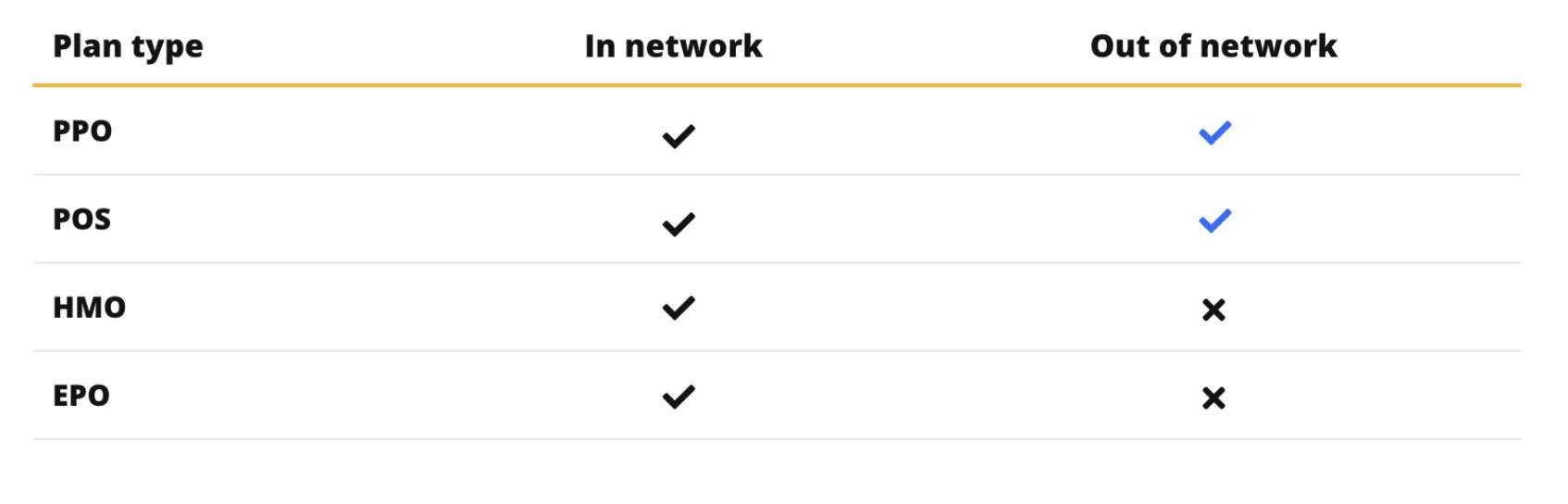

Not all insurance plans offer out-of-network benefits. Plans that commonly provide such benefits include Preferred Provider Organization (PPO) and Point of Service (POS) plans. In contrast, Health Maintenance Organization (HMO) and Exclusive Provider Organization (EPO) plans usually do not cover out-of-network services. Depending on your health insurance plan, eligibility for reimbursement typically ranges from 50% to 80% of our appointment fees once the out of network deductible amount has been met.

To check your out-of-network coverage:

- Review Your Insurance Policy: Your policy document will have detailed information on whether out-of-network services are covered and to what extent.

- Contact Your Insurance Provider: Reach out to the member services number located on the back of your insurance card and request to speak with the Benefits Department. Inquire specifically about your coverage for Mental Health Outpatient Visits in an office setting, without testing. Should they ask for specific billing codes, provide them with the appropriate code(s).

- 90791 – Psychiatric Diagnostic Evaluation (intake session, individuals only)

- 90834 – 45 minute psychotherapy session (follow-up sessions, individuals only)

- 90847 – 45 minute Family psychotherapy, conjoint psychotherapy with the patient present (Couples or Family therapy)

- Online Account Access: Many insurers provide online portals where you can access detailed information about your plan, including out-of-network coverage.

The Importance of Understanding Your Coverage

Knowing the details of your out-of-network coverage is crucial. It helps you make informed decisions about seeking healthcare services and preparing for potential out-of-pocket expenses. Understanding your insurance plan’s specifics, such as the percentage of costs covered and the deductible amount for out-of-network services, is vital in managing your healthcare finances effectively.

What are Superbills and How Are They Used?

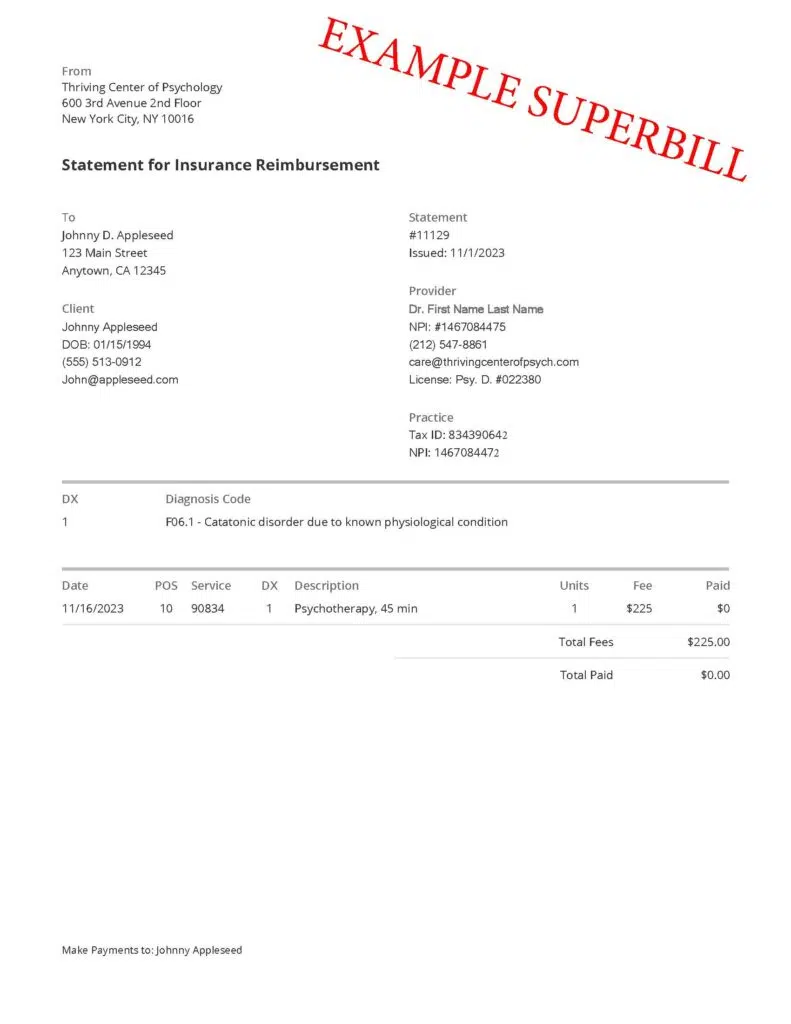

A superbill is essentially a detailed invoice provided to patients by healthcare providers after receiving out-of-network services. Unlike a standard receipt, a superbill contains comprehensive medical information necessary for insurance claims. This includes:

- The provider’s full details (name, address, and contact information).

- The patient’s personal and insurance information.

- Date of service and detailed descriptions of the services provided.

- Procedure codes (CPT codes) that represent specific health services.

- Diagnosis codes (ICD-10 codes) that categorize the patient’s health condition.

Superbills are crucial for patients who visit out-of-network providers and wish to seek reimbursement from their insurance companies. They serve as the bridge between the healthcare provider and the insurance company, ensuring that patients have all the necessary information to file a claim.

How are Superbills Submitted?

Submitting a superbill for insurance reimbursement has become more accessible, thanks to electronic submission processes and third-party assistance. Here’s how you can effortlessly handle your superbill submission:

- Review the Superbill: Quickly check your superbill for accuracy and completeness. This is an important step to ensure your claim is processed smoothly.

- Utilize Electronic Submission: Most insurers now offer convenient online platforms for submitting claims. This typically involves uploading your superbill and any additional required documents digitally, making the submission process quick and efficient.

- Fill Out Additional Forms(if Needed): Sometimes, your insurer may require additional forms. These are usually downloadable from the insurer’s website and can be submitted electronically along with your superbill.

- Consider Third-Party Assistance: For an even easier submission process, services like Reimbursify offer to handle the submission for you for a small fee. They specialize in managing healthcare reimbursement claims, simplifying the process for patients. This can be a great option if you’re looking for extra assistance and convenience.

- Follow Up on Your Claim: Keep track of your claim’s status, typically available through your insurer’s online portal. If further information is needed, be prepared to respond promptly to your insurance company’s requests.

By leveraging electronic submission methods and possibly third-party services like Reimbursify, managing your superbill submission becomes a hassle-free experience, allowing you to focus on your healthcare needs.

Insurance Reimbursement & Superbills at Thriving Center of Psychology

At Thriving Center of Psychology, the process for providing superbills is tailored to support clients in their journey toward mental wellness, while also acknowledging the complexities of insurance reimbursements. Here’s an overview of their comprehensive procedure:

- Out-of-Network Policy Reminder: Thriving Center of Psychology is an out-of-network provider with all insurance plans. This means the practice does not handle preauthorizations and cannot confirm eligibility or benefit coverage directly.

- Client Responsibility in Insurance Communication: Patients are encouraged to independently verify their out-of-network benefits. This involves contacting their insurance provider, which can be done by calling the member number on the back of the insurance card and connecting with the Benefits Department. The focus should be on confirming eligibility for Mental Health Outpatient Visits in an office setting, specifically for services without testing.

- Providing Essential Billing Codes: For patients who require them, the Thriving Center provides crucial billing codes (CPT codes)These codes are necessary for insurance companies to identify the nature of the services provided. Below are the codes Thriving Center uses.

- 90791 – Psychiatric Diagnostic Evaluation (intake session, individuals only)

- 90834 – 45 minute psychotherapy session (individuals only)

- 90847 – 45 minute Family psychotherapy, conjoint psychotherapy with the patient present (Couples or Family therapy)

- Monthly Superbill Generation: The Center generates superbills on the 1st of every month. This regularity ensures that patients have timely access to the documents necessary for insurance claims.

- Secure Access to Superbills: Patients are invited to access their superbills through the Thriving Center of Psychology’s secure client portal. This ensures privacy and ease of access.

- Comprehensive Information on Superbills: Each superbill includes all information required for insurance reimbursement. This includes the patient’s name, date of service, clinician’s name, diagnosis code (DX code), CPT/billing code, session rate, the practice’s tax ID, and other relevant details.

- Submitting Superbills for Reimbursement: Patients are instructed on how to submit their superbills for reimbursement. This can be done through their insurance company’s portal/profile or via fax, email, or traditional mail to the insurance’s Claims Department.

- Empowering Patients: By providing clear instructions and the necessary documentation, Thriving Center of Psychology empowers patients to navigate the reimbursement process with their insurance providers effectively.

Navigating superbills and out-of-network insurance can be straightforward with the right guidance. Understanding these elements is key to confidently managing your healthcare journey. At Thriving Center of Psychology, we simplify this process, focusing on your therapeutic progress while ensuring a smooth financial path.

Start your journey with us for a therapy experience that’s both healing and hassle-free. Our dedicated team is ready to match you with the ideal therapist for your unique needs. Embrace wellness with Thriving Center of Psychology — View our providers here, book an appointment online or call our office today, and let us make your path to healing a supported and rewarding experience.

Unwind From the Chaos: A Beginner’s Guide to Mindfulness Meditation for Stress Relief

Research increasingly supports the effectiveness of mindfulness for stress reduction. Mindfulness focuses on self-management and empowering an individual to manage their own stress. So, how can mindfulness meditation help with stress, and what are the best ways to get started with your own practice? Let’s dive in.

How Do I Establish Healthy Boundaries

We often talk about setting healthy boundaries in the workplace, in relationships, with technology, and with ourselves. But what is a healthy boundary, why should you have them for your mental health, and what’s the best way to establish healthy boundaries? Let’s dive in.

Millennials in Crisis: Survey Finds 81% Can’t Afford a Midlife Crisis

Are Millennials a generation in crisis? Millennials are aging. The oldest in the generation is now 43, and the youngest is now 28. With age comes wisdom, but it also often leads to regret, nostalgia, and introspective questions about where people are in life. With the generation quickly approaching “middle age,” many are starting to feel these pressures.

What Are Practical Strategies for Managing Depression?

The number of U.S. adults who have been diagnosed with depression is on the rise, with young adults and women experiencing the most significant increases. We know that the effects of depression can ripple through every aspect of your life.